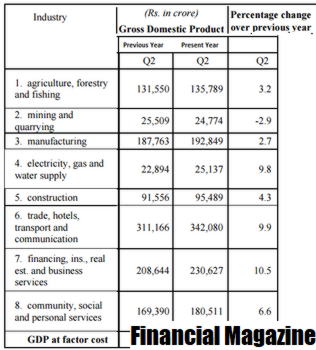

For example, the United States has had a commerce deficit since 1976 because of its dependency on oil imports and consumer merchandise. Conversely, China, a country that produces and exports many of the world’s consumable items, has recorded a commerce surplus since 1995. Trade deficits is usually a good or a nasty sign for an financial system, and commerce surpluses can be a good or a bad sign.

What is trade measured by?

Vertical trade can be measured by looking at the import content of exports, i.e. the share of imported inputs in the total amount of inputs used to produce one exported unit of a product.

Current account transactions are called account of actual transactions,because all items included in it are actually transacted.These items have a direct effect on the income,output and employment of a country’s economy. So, the balance of trade is used to determine the economic strength of the country in comparison to other nations. Balance of trade is considered a crucial factor of the country’s current account.

It is also potential for a country’s trade to be a relatively low share of GDP, relative to world averages, but for the imbalance between its exports and its imports to be fairly large. This general theme was emphasized earlier in Measuring Trade Balances, which offered some illustrative figures on trade levels and balances. A high level of commerce indicates that a great portion of the nation’s production is exported. The capital account consists of a nation’s transactions in financial instruments and central bank reserves. It represents the country’s imports & exports of goods as well as services, payment to foreign nationals, transfers, and foreign aids. Unfavourable terms of trade can cause problems in foreign trade, like payment for export in international currency etc.

For more notes on International Business Management click on the link below:

Balance of payments is unfavorable when its payments are more than its receipts. In this case exports of goods, services and capital receipts are less than import of goods, services and capital receipts are less than import of goods, services and capital payments. If all transactions between the two countries are properly included, then the funds and receipts between the 2 countries will be equal. For example, if a rustic exports an merchandise, then it technically imports foreign capital as fee for the merchandise exported. However, typically a country can’t fund its purchases and finally ends up dipping into its reserves to make funds. Statistical discrepancies usually happen because it’s tough to account for every transaction between two nations accurately.

The capital account also includes the flow of taxes, purchase and sale of fixed assets etc., by migrants moving out/into a different country. The deficit or surplus in the current account is managed through the finance from the capital account and vice versa. These transactions consist of transfer payments as well as the export and import of products, services, and financial assets . The current account is used to record the inflow and the outflow of goods between nations.

It is a situation where aggregate demand is less than aggregate supply at the level of full employment. Graphically, it is represented by the vertical distance between the aggregate demand at the full employment level of output and the actual level of aggregate demand . In the figure below, EY denotes the aggregate demand at full employment level of balance of trade is measured as: output and CY denotes the actual aggregate demand. The vertical distance between these two represents deflationary gap. Such transactions are undertaken as a consequence of the autonomous transactions. In other words, they are compensating short-term capital transactions that are undertaken to correct the disequilibrium in the autonomous items.

What is the Balance of trade?

Payment Balance or BoP is a statement or record of all financial and economic transactions that are made nationally and internationally over a period of time . These records include transactions made by individuals, companies and governments. Keeping a record of these transactions helps the country monitor cash flow and develops policies that can help build a strong economy. Imbalances within the BOP can create political tensions between international locations and disrupt the world’s political local weather. To calculate the BOP, you should calculate the sum of the country’s exports and imports.

What is balance of trade measured as Mcq?

The difference between the value of a country's exports and the value of its imports for a certain period is known as the balance of trade (BOT).

The key element in any country’s economic development is foreign trade. The balance of trade is sometimes divided into a goods and a services balance. Due to this, the domestic business is not able to add value to their products due to lack of experience and skills. With time, these economies become dependent on global commodity prices. Any transaction that causes money to flow into a country is a credit to its BOP account, and any transaction that causes money to flow out is a debit.

In easy terms, a trade deficit means a rustic is shopping for more goods and providers than it is promoting. An overly simplistic understanding signifies that this is able to generally harm job creation and economic development within the deficit-working country. Theoretically, a trade deficit can hurt a rustic’s employment ranges if its goods aren’t purchased overseas. That’s because the country whose items don’t enjoy overseas or domestic demand may lose jobs in manufacturing these goods, potentially causing the financial system to suffer. A trade deficit or a negative trade balance is when a country buys more products and services in terms of value than it exports.

Features of Balance of Payments

The role of a Trade Deficit or surplus can also give countries weaponry in international relations help countries negotiate a better position on the international political spectrum. During times of recession, countries often have to import to maintain supply chains and ensure their citizens have the necessary resources. Balance of Trade is important in calculating the balance of Payments of countries. Exports also enable a country to compete in an international market thus increasing competition and efficiency. Thus brings out the first type of Balance of Trade – Favourable Balance of Trade. The concept of Balance of trade also gives rise to two more terms – Trade Deficit and Trade Surplus.

You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Balanced Economy – In national finances, it is when exports are equal to imports. Balance Sheet – A financial statement of an individual, company or organisation, which shows assets and liabilities at a specific date.

Raw materials should be made available to export industries at international prices.Production capacity of cement,fertilizers,iron and steel etc. should be utilized fully. In 1991,Gulf Warhad also its adverse effect on India’s balance of payments.On the one hand,price of petrol shoot up and on the other,foreign remittances by Indians working in gulf area,viz., Kuwait,Iraq,etc. To India altogether stopped.It rendered the imports expenses and reduced the foreign remittances. The huge interest burden also caused disequilibrium in th balance of payments.This item does not affect balance of trade, as it is an invisible item. In order to defend itself against China and Pakistan, large amount of war equipment were imported by India.These imports also caused disequilibrium in the balance of payments. “Balance of payments of a country is record of the monetary transactions over a period of time with the rest of the world”.

Components of Balance of Trade:

When the foreign ownership is more compared to the domestic ownership it results in a deficit in the financial account. Thus analysing and understanding the changes in financial account allows determining whether the country is selling or acquiring more assets. Reports relating to import and export of Indian economy are published every month by the ministry of commerce. India’s economic development is mainly evaluated through India’s merchandise trade with the U.S, E.U and China. Balance of Payment is defined as the ‘flow of cash between domestic country and all other foreign countries’. It includes not only import and export of goods and services but also includes financial capital transfer.

Indeed, commerce deficits are inclined to rise during periods of sturdy economic growth. The Balance of Payments is a sophisticated worldwide financial method used to understand all the transactions that a rustic conducts with these abroad. The transactions embody every thing that is undertaken by that nation’s individuals, corporations and government our bodies and consists of all imports and exports. Balance of payments on current account includes the value of imports and exports of both visible and invisible items.

What is the formula of trade balance *?

The balance of trade formula subtracts the value of a country's imports from the value of its exports. Balance of Trade = Value of Exports – Value of Imports.

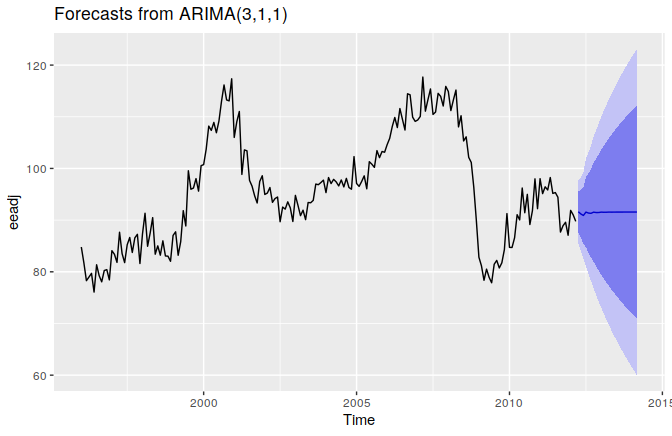

Imports have been elevated this year owing to a sharp rise in commodity prices. For the April-January period, India’s goods imports surged to $601.7 billion as compared to $494.3 billion in the same period of last year. The World Trade Organisation’s Services Trade Barometer, which illustrates the current state of services trade, also shows a likely slowdown in services trade activity in the coming months. Toward another trading partner, rather than creating or increasing the overall trade deficit. Certain goods simply cannot be produced domestically, or are much cheaper to produce abroad due to climate, natural resources, or other reasons.

In the US, while overall inflation has fallen and goods prices have declined, inflation in the broad array of services continues to remain elevated. The US Federal Reserve has conceded that disinflation is yet to take hold in the services sector. The bank would take a closer look at the service prices to decide on the future course of monetary policy tightening. According to the Barometer, world services trade activity appears to have weakened in the December quarter of 2022 and is likely to remain weak in the opening months of 2023.

As such, countries with trade deficit export raw materials and import a large number of consumer products. If a country has a balance of trade deficit, it imports more than it exports, and if it has a balance of trade surplus, it exports more than it imports. Balance of Trade is regarded as the difference between the value of export and Import of a country for a specific period of time. A current account is a key component of balance of payments, which is the account of transactions or exchanges made between entities in a country and the rest of the world. When capital receipts of a country and exports are to its capital payments and imports then its balance of payments is in equilibrium.

Members include; People’s Republic of Bangladesh, India, Cambodia, The Philippines, Republic of Korea, Sri Lanka and Thailand. Balloon – Describes a long term loan in which there is a large final payment when the loan matures. Bad Debt Expense – The difference between what the customer was charged and what they paid. In contrast, inflows as part of trade in travel-related services have been hit since the onset of Covid and geo-political disruptions.

Causes of Unfavourable Balance of Payments/Unfavourable Balance of Trade

The economy is at full employment equilibrium at point “E”, where AD1 intersects at AS curve. At this equilibrium point, OY represents the full employment level of output and EY is the aggregate demand at the full employment level of output. The economy is at full employment equilibrium at point “E”, where AD1intersects AS curve. At this equilibrium point, OY represents full employment level and EY is aggregate demand at the full employment level of output. Invisible services includes such as shipping, insurance, expenditure by the tourist etc. The monetary authorities of a country are the financiers when any deficit arises in the country’s balance of payment.

The current account is used to record the receipts and payments of all exported and imported goods that include raw material supplies and manufactured goods. When the exports are greater than imports then there is a trade surplus. A balance of trade deficit or surplus are not always considered important indicators to assess the economy of a country. However, these two factors should be present in a business cycle amidst others. Balance of Trade is also an important determinant of a country’s foreign exchange reserves. Through government taxes, the Central Bank can impose export tariffs and thereby increase a nation’s foreign exchange reserves.

- For example, an rising market ought to import to put money into its infrastructure.

- BOP is in deficit if the autonomous receipts are less than autonomous payments.

- A country’s stability of trade is the dollar difference between its exports and imports.

- Here are some of the leading causes of an increase in a country’s trade deficit.

- Along with loans and debts through treasury bonds, the trade deficit or surplus can also be included in Balance of Payments.

- In other words, the BOP deficit would be reflected in a depletion of foreign exchange reserves of the country.

This can cause deflation, a state in which reduced demand leads to lower prices. A country may have a trade deficit because it is cheaper to purchase goods internationally than to produce them at home. India’s merchandise trade deficit increased from below $24 billion in November to $24.24 billion in December. While understanding the Current Account Deficit in detail, it is important to understand what the current account transactions are. But if foreign investors worry they won’t get a return in a reasonable amount of time, they will cut off funding. Rise capital inflows- If there is a deficit on the current account, there will be a surplus on the Financial/Capital account to compensate for the net withdrawals.

What is trade measured by?

Vertical trade can be measured by looking at the import content of exports, i.e. the share of imported inputs in the total amount of inputs used to produce one exported unit of a product.